Sony Xperia Miro Review

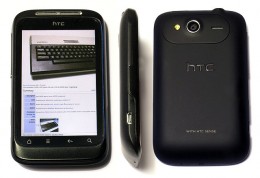

The Sony Experia Miro, with its 3.5-inch screen, fits nicely in the hand and it is not bulky. | Source

The Sony Xperia Miro, while it is not cheap, it is one of the more economical offerings in the Sony Xperia smartphone line. It has many features that make it a smart purchase as a cell phone. It comes with Android 4.0.4 installed, also known as Ice Cream Sandwich, one of the more advanced Android operating systems. It is also light and has a long battery life.

One of the great features of this phone is that it comes unlocked. So, this means you can use it with any GSM or CDMA provider that will sell you a SIM card. No contracts means less money out of your pocket and more freedom to choose or lose a carrier.

More pros and cons of this device are covered below to give you an outline of this phone's important features and specifications. Photos and two videos from the camera are also included to demonstrate its capabilities in that regard.

Pros and Cons

Here is a quick overview of the pros and cons for this device. For explanations on some of the evaluations, read the text further down in the article.

Pros

Easy to handle, not bulky (2 1/4 x 4 3/8 inches, 57 x 102 cm; 5/8 in or 1 cm thick)

Solid build, nice finish on the back

It is relatively economical for a smartphone and compared to Sony's other Xperia models

Accommodates a 32 GB SD card for storing songs, videos, documents and applications

Speaker quality is excellent, call quality is excellent

Easy to read screen *(see below)

Has Android 4.0.4, Ice Cream Sandwich

Works on both CDMA and GSM cell phone networks

Has excellent cell phone signal reception

It is easy to access software updates from the Sony website

A widget on the home screen controls many basic functions: airplane mode, backlight, sound, etc, for quick changes as needed

Touch screen is not over-sensitive when using controls

Battery life is good, and it can be swapped out easily by the user if need be

Cons

Wifi signal reception is weaker than that observed with iPhones, particularly the iPhone 4S and later models

Camera is 5.0 MP and its photos leave a lot to be desired (see below), but some of the owes can be fixed by downloading another camera app - Camera FX Zoom (paid)

The screen size is 3.5", which is the same size as a iPhone 3G and 3GS - a bit small for some, and the resolution is not very good with some applications. But I have no complaint with my old eyes reading news and web pages onPulse and Flipboard.

This phone is not going to get an update to Android 4.1, Jelly Bean - perhaps because it doesn't have the full feature set required to take advantage of the more recent software. If you want a cell phone that does that, buy a newer or more expensive Xperia model like the Z.

Other Sony Xperia Smartphones

Sony Xperia M4 Aqua 16GB GSM/LTE Unlocked Cell Phone - Black (U.S. Warranty)

Sony Xperia M4 Aqua 16GB GSM/LTE Unlocked Cell Phone - Black (U.S. Warranty)Buy Now

The opened widget for controlling the various power-consuming functions on the phone. | Source

A Summary of the Good and Bad of the Sony Experia Miro

Overall, this smartphone from Sony gets kudos for its build, handling, and ease of use. It is primarily a phone and a Walkman with Android features and capabilities. And as that goes, it is excellent.

On the other hand, the photographic capabilities are limited but they can be improved by downloading the camera app mentioned above. In this aspect, I think Sony could have done much better, as I have seen 5 MP cameras on several much older phone models that far outshine the one on this smartphone. See the photo examples below.

The Radios. As a cell phone, it works well in areas with weak cell phone signals. And since it can work with both GSM or CDMA carriers, it can be used across a spectrum of carriers. The radio for data works well also. The WiFi radio reception is weak. It works in most cases, but it is limited as compared with the WiFi receiver on the iPhone. Also, I am not impressed by the FM/AM radio - it is impossible to get good reception, even when you follow instructions and use earphones. (Do I have to buy special earphones?)

Battery Life. With Android phones, you can multitask with many applications in the background and this can reduce battery life. However, when using this phone with several apps, it seems to keep a decent battery life. It usually lasts a bit more than a day. And, with the functions widget, you can shut of power-eating features like WiFi, data, backlight and GPS very quickly. I also advise any Android device owner to have the Android Assistant application available on one of their home screens to help kill applications that accumulate in the background.

The Big Disappointment. As I have already said, the biggest let down is the camera. As you can see below, most of the photos below leave a lot to be desired. The colors are rich, but washed out and blurry photos are common. It doesn't handle shots well where there is a mixture of dark areas and light. It doesn't handle dark scenes well, although there is an adjustment for that which helps somewhat. Light areas are often washed out and the dark areas are completely black in scenes where there are sharp shadows. Also, the daytime videos are okay, but they aren't HD, as you can see below.

To help tweak the camera to get better shots in the dark, I recommend downloading FX Camera Zoom. It has more features that the standard camera set and it has a more intuitive user interface. Otherwise, you may be able to use Photoshop or some other photo editing program to take care of the shadow problem.

Photos Taken with the Xperia Miro

A shot taken early in the morning, with a substantial ground shadow. The camera seems to have difficulty with this type of scene. | Source

Another building shot taken early in the morning, without the inclusion of the shadows, as seen in the earlier photograph. | Source

The camera seems to have difficulty in freezing movement with the flash at night. For that reason, I don't recommend relying on this phone for that capability. Bring a real camera. |Source

Boys walking a bannister rail for fun. One boy fell with a loud thump, but got up with no injuries. | Source

Nightime Video

A Video in a Well-Lit Store - Bubble Machine Demo

Sony Xperia Miro Update Info

This particular model seems to be locked in to Android 4.0.4, Ice Cream Sandwich, as news from Sony shows that they are focusing more on their high-end models. However, after having the phone for 3 months, I have gone through two updates on the phone using the Sony PC Companion software that is on the phone (it automatically installs on a Windows computer, but not on a MacBook). The second update, about the second week of February of 2013 caused me to lose my data connection, but I removed the battery and started it up again and to restore the data connection again. These updates seem to be related to the Sony skin only, and I have not seen any obvious changes or improvements in performance.

Sony PC Mobile Companion

Sony PC Companion has several features that help you keep the phone up to date and has backup features for your contacts and calendar events. You can move files back and forth, and back up your photos. If you wish to use something like the Carbon app for a full backup, don't waste your time if you have the Windows 8 operating system - even if you download the drivers that are associated with the PC Companion application, Carbon will not recognize the phone.

If you happen to have a Mac, you are out of luck with using the Sony PC Mobile Companion. The phone recognizes a connection, but the Mac computer doesn't. (Thanks, Sony) So, to transfer and delete files, you will need to use an application like WiFi File Transfer (free). If you have all your contacts in a gmail account, you won't have to worry about backing them up, it is done automatically when you add one on the phone or online.

Doing an Android System Restore

So, what if some glitch happens in your Android software on this phone? This is more common than you may think. If you have your contacts information and other data backed up on the phone, you can restore it. To access the menu, first swipe down from the top then click "Back up and Reset" and then click on Factory Data Reset." This erases all data on the phone, so make sure you do a backup of your contacts with your Google account beforehand, and afterward restore your contacts.